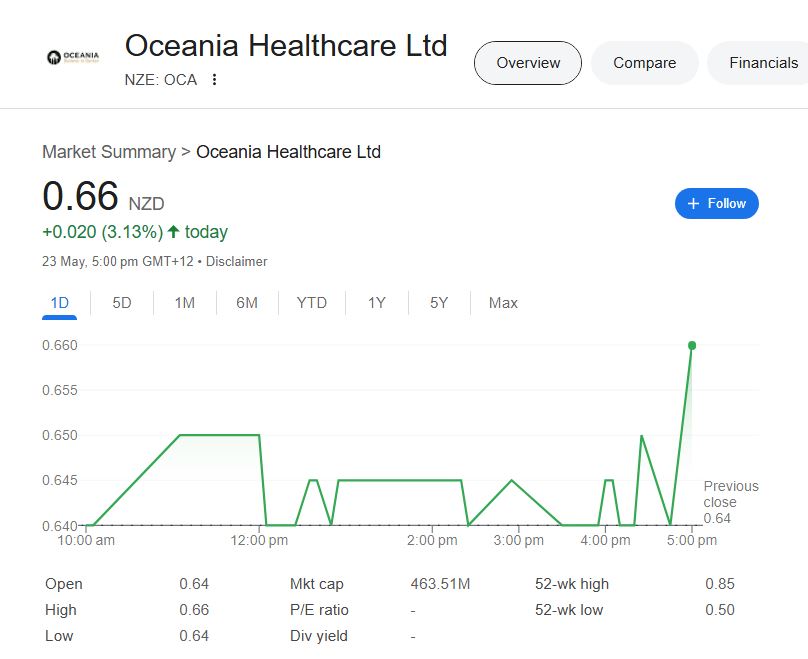

Oceania Healthcare Ltd (OCA) has experienced stock price volatility in recent months, mirroring broader market trends and the changing dynamics of New Zealand’s healthcare industry. On May 23, 2025, the share price is NZD 0.66, reflecting a 3.13% daily increase. The company’s 52-week trajectory reveals both favorable and unfavorable fluctuations, with a peak of NZD 0.85 and a trough of NZD 0.50.

Given New Zealand’s aging demographic and increasing demand for aged care, Oceania Healthcare’s role as a significant entity in the healthcare sector positions it at the forefront of a vital and pertinent industry. The company, with a market capitalization of NZD 463.51 million, presents investors with a robust opportunity in the sector, notwithstanding certain fluctuations in its stock price.

Oceania Healthcare Stock Metrics: A Snapshot of Performance

As of May 23, 2025, Oceania Healthcare’s stock performance shows solid growth, even amidst market fluctuations. Here’s a closer look at its current stock performance and key metrics:

| Company | Stock Symbol | Current Price | 52-Week High | 52-Week Low | Market Cap | Volume (May 23) |

|---|---|---|---|---|---|---|

| Oceania Healthcare Ltd | OCA | NZD 0.66 | NZD 0.85 | NZD 0.50 | NZD 463.51 million | 679,626 |

Due to the rising demand for elderly care services in New Zealand, Oceania Healthcare constitutes a significant long-term investment opportunity. Notwithstanding a negative net income margin of -7.78%, the company persists in augmenting its dividend yield, presently at 4.20%, providing a measure of stability and dependability that numerous investors value during volatile periods.

Demand for Aged Care Fuels Expansion: Oceania Healthcare’s Robust Standing

Oceania Healthcare’s business model, integrating residential care with retirement living solutions, is notably innovative and increasingly in demand. The swiftly aging population of New Zealand, along with an increasing emphasis on elder care, renders Oceania Healthcare’s services more essential than ever.

The company manages more than 50 facilities and has been leading in addressing the varied requirements of the elderly population. The augmented government investment in healthcare has enhanced Oceania Healthcare’s growth potential, establishing the company as a principal beneficiary in the medical care facilities sector.

Despite a current profit margin of -7.78%, Oceania Healthcare’s capacity to produce consistent revenue serves as a robust indicator of its financial stability. The company’s investment in infrastructure, encompassing expansions in retirement villages and additional care services, enables it to address the persistent demands of the aging population while enhancing operational efficiency.

Reasons for the Increasing Interest in Oceania Healthcare Stock

Oceania Healthcare’s stock has attracted investor interest for multiple reasons. The company’s dividend yield of 4.20% renders it an appealing choice for investors pursuing reliable income. Furthermore, Oceania’s sustained growth trajectory is fundamentally anchored in the increasing demand for elderly care services, which is expected to persist as New Zealand’s population ages.

Investors are also reassured by the company’s strategic trajectory, which encompasses expanding its market presence in pivotal regions and enhancing its care services. These initiatives aim to improve service quality and broaden the customer base, positioning Oceania Healthcare as a stable option with considerable growth potential.

Anticipations for Oceania Healthcare in 2025 and Subsequent Years

With the increasing demand for aged care services, Oceania Healthcare’s stock is likely to experience gradual appreciation. The company, with a P/E ratio of 15.24, is competitively priced relative to numerous peers in the healthcare sector. This valuation renders it an especially attractive choice for long-term investors pursuing stability and reliable returns.

Oceania Healthcare is poised to maintain its advantageous market position, especially as it prioritizes the expansion of its retirement living offerings and leverages the demographic trend of an aging population. The present dividend yield serves as a compelling incentive for income investors, while the company’s prospective growth strategy fosters optimism for enhanced shareholder value in the future.

An Investment with Long-Term Strategic Value

In summary, Oceania Healthcare Ltd presents a favorable investment prospect within the healthcare industry. Despite experiencing short-term volatility, the company’s robust market positioning, resilient growth strategy, and dividend offerings render it an appealing choice for long-term investors. The growing dependence of the elderly population on aged care services renders Oceania Healthcare’s offerings critically important, solidifying the company’s status as a significant entity in New Zealand’s healthcare sector.

Individuals seeking exposure to the healthcare sector should consider Oceania Healthcare’s stock, especially for its consistent returns and growth potential. As the company adapts to market demands, it is poised to remain a dependable and lucrative option for forward-thinking investors.