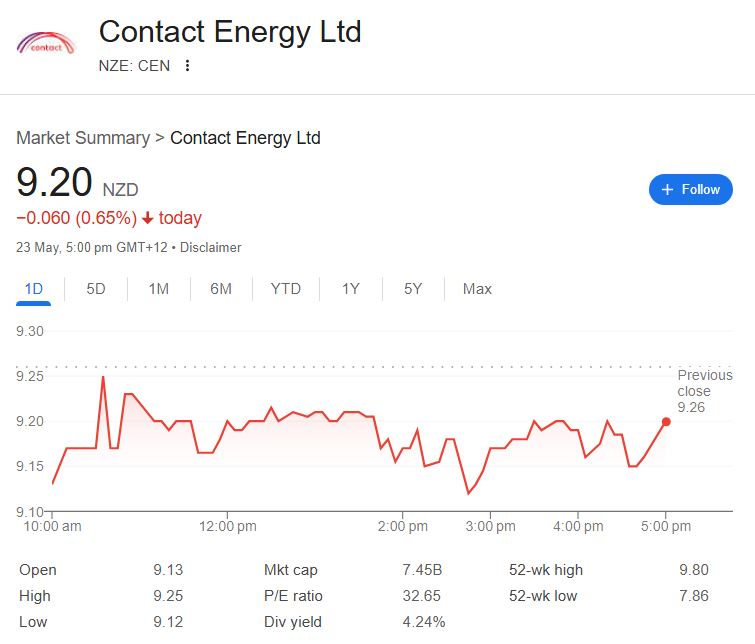

Contact Energy Ltd (CEN) continues to be a significant entity in New Zealand’s energy sector, integrating conventional and renewable energy sources to satisfy increasing demand. As of May 23, 2025, the share price is NZD 9.20, indicating a 0.65% decline for the day. Notwithstanding this slight decline, the company’s stock has increased by 3.37% over the past year, demonstrating its resilience in the face of market adversities. Contact Energy, due to its prominent role in the renewable energy sector, provides both stability and long-term growth prospects.

Nonetheless, the energy market is perpetually changing, and Contact Energy’s stock price has experienced significant volatility. The 52-week high of NZD 9.80 established in December 2024 contrasts with the more subdued 52-week low of NZD 7.86 recorded in September 2024. These fluctuations highlight the challenges encountered by energy providers as they manage the equilibrium between demand, regulatory modifications, and transitions to sustainable energy sources. This volatility offers investors both risks and opportunities.

Contact Energy has sustained a robust market capitalization of NZD 7.45 billion, reflecting confidence in its capacity to address the challenges of the energy sector and the increasing global demand for sustainable energy solutions. The P/E ratio of 32.65 indicates a substantial premium assigned to the stock, attributed to its anticipated future performance, particularly as governments and industries worldwide advocate for cleaner, more efficient energy alternatives. The dividend yield of 4.24% presents an appealing aspect for income-oriented investors.

Here’s a closer look at its recent stock data:

| Company | Stock Symbol | Current Price | 52-Week High | 52-Week Low | Market Cap | Volume (May 23) |

|---|---|---|---|---|---|---|

| Contact Energy Ltd | CEN | NZD 9.20 | NZD 9.80 | NZD 7.86 | NZD 7.45 billion | 708,195 |

Essential Stock Metrics of Contact Energy

Notwithstanding recent declines, Contact Energy maintains a comparatively strong performance relative to its sector counterparts. The dividend yield continues to be an attractive element for long-term investors pursuing stability and consistent income from a utility firm.

Centralizing Sustainability: Contact Energy’s Investments in Renewable Resources

Contact Energy has achieved significant progress in renewable energy, emphasizing hydroelectric and geothermal power as its principal sources for electricity generation. In a world increasingly prioritizing sustainability, the company’s dedication to green energy provides it with a competitive advantage in New Zealand’s energy market. It not only addresses local demand but also plays a substantial role in New Zealand’s carbon-neutral objectives.

The company’s dependence on renewable energy is exceptionally efficient in sustaining its competitive advantage while controlling operational expenses. As nations and corporations globally prioritize cleaner energy alternatives, Contact Energy’s involvement in geothermal and hydroelectric power affords it an advantageous market position. For investors aiming to align their portfolios with sustainability trends, Contact Energy’s stock constitutes a significant opportunity.

Contact Energy: A Reliable Option in Market Volatility

The company’s revenue of NZD 3.26 billion and net income of NZD 224 million indicate its solid position in a volatile sector. The present P/E ratio of 32.65 is comparatively elevated for the industry, yet it indicates robust market confidence in the company’s long-term strategy. Although the net profit margin of 6.86% appears modest, it is crucial to recognize that utility companies, particularly those engaged in renewable energy, typically function with lower margins owing to the capital-intensive characteristics of energy infrastructure.

Future Projections: What Lies Ahead for Contact Energy Shares?

Contact Energy anticipates challenges and opportunities in a swiftly transforming energy market. The demand for the company’s services will persist due to the emphasis on renewable energy; however, regulatory modifications, energy costs, and technological advancements in the sector are expected to impact its stock price. As a utility company, Contact Energy is intrinsically linked to long-term trends; however, the market volatility observed this year serves as a reminder of the external pressures inherent to the industry.

The company’s emphasis on innovation, particularly in green energy, and its capacity to adjust to evolving market demands, strategically positions it for sustained success. In light of the increasing emphasis on clean energy and carbon reduction, Contact Energy’s stock possesses significant long-term growth potential, particularly if it can persist in augmenting its renewable energy portfolio.

An Intentional Investment in a Sustainable Future

In summary, while Contact Energy’s share price may vary, the company’s commitment to renewable energy, robust market positioning, and consistent financial performance render it a reliable choice for investors seeking to engage in the green energy sector. Despite ongoing short-term volatility, Contact Energy demonstrates significant resilience in a challenging market. Contact Energy Ltd is an appealing option for long-term investors desiring exposure to the renewable energy sector, providing both growth potential and consistent income in a dynamic global market.