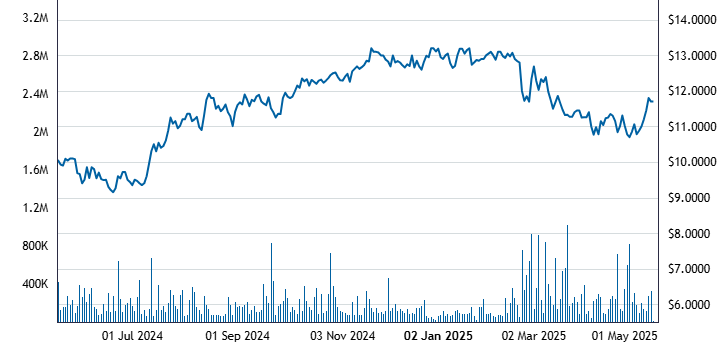

The share price of Summerset Group Holdings fell 4.85% in a single session to $10.40 on May 15. Although short-term traders may find this decline unsettling, the larger story indicates otherwise. The share price has increased 11.59% in the last 12 months, indicating that the company is still maturing steadily in a market that is growing quickly. A short-term tremor that obscures a longer-term structural strength is a classic example.

Summerset has created a particularly robust business model by fusing real estate, healthcare, and lifestyle into a remarkably powerful growth engine through the integration of property development and elder care. With scale, stability, and a great deal of foresight, Summerset is well-positioned to meet the growing demand for high-quality retirement living as the population of New Zealand ages. The slight swings in recent trading are a reflection of market breath rather than panic.

| Category | Details |

|---|---|

| Instrument Name | Summerset Group Holdings Limited Ordinary Shares |

| ISIN | NZSUME0001S0 |

| Ticker Symbol | SUM |

| Current Share Price | $10.40 NZD (as of May 15) |

| 1-Month Change | -0.95% |

| 12-Month Change | +11.59% |

| Market Capitalisation | $2.82 Billion NZD |

| P/E Ratio | 8.106 |

| EPS | $1.442 |

| Dividend Yield | 2.094% |

| Reference | NZX: Summerset |

Elevated Senior Living: The Significance of Summerset’s Core Values

Summerset is among the most strategically positioned businesses in Australasia in light of the demographic shift. The business presently runs or is building 43 villages in areas like Cranbourne North, Cambridge, Dunedin, and Ellerslie. With over 7,970 units overall, 6,671 of which are for independent living, the scale is not only remarkable but also remarkably creative for a historically slow-moving industry.

Summerset is creating lifestyle ecosystems rather than just retirement homes by providing amenities like cafes, hair salons, and exercise centers in addition to bowling greens. In addition to increasing word-of-mouth appeal among senior populations, this experiential focus dramatically lowers resident turnover. This translates into consistent revenue, brand loyalty, and community-driven valuation growth for investors.

Long-Term Strength Is Not Disrupted by Recent Volatility

Despite its apparent sharpness, the recent share price decline must be viewed in the context of market cycles and fluctuations in sentiment. Summerset has lost less than 1% over the last four weeks, which is a modest correction in comparison to more significant sectoral movements brought on by inflationary fears and interest rate speculation. The company’s structural advantages and the resilience of its demand base have not been substantially diminished by these transient pressures.

Summerset has significantly enhanced its cost control and project delivery schedule by utilizing internal construction teams. These two elements serve as a buffer for profitability in unpredictable economic times. Institutional investors are aware that the stock is trading below its intrinsic value because its Net Tangible Asset (NTA) value, which is currently $12.531, is still higher than the share price.

Real Estate and Healthcare: The Untapped Potential of Hybridization

In an economy where housing shortages, healthcare demand, and inflation all intersect, Summerset’s hybrid model of fusing real estate development with aged care service delivery is especially advantageous. The business has more control over end-user experience, operational schedules, and capital deployment thanks to this vertical integration. Summerset’s integrated ecosystem creates a competitive moat in an industry where many rivals outsource or work in silos.

Notably, their amenities range from pool tables and organized resident activities to communal gardens and spas, establishing a lifestyle brand as opposed to merely a care provider. This change is indicative of a broader consumer trend among retirees who are looking for wellness, social connection, and purpose in their later years. Summerset has made it very evident that it is dedicated to changing the perception of aging in contemporary New Zealand.

Viewpoint on Valuation: Undervalued and Underpriced?

Given the company’s size and growth trajectory, Summerset is trading at a valuation that feels surprisingly affordable, with a P/E ratio of 8.106 and a dividend yield above 2%. Summerset’s current pricing indicates opportunity rather than concern, in contrast to other retirement living companies in Australia and the U.S. that typically command P/Es in the 12–18 range.

This is a seasoned, asset-heavy business providing real, necessary services, not a speculative tech stock that is betting on unproven growth. The recent decline in shares could just be the market’s normal release—an opportunity for astute investors to build up equity in a company with a demographic wind at its back.