I’ve been watching Sarepta Therapeutics for months now. And let me tell you, what just happened to this stock hit like a freight train. The drop in SRPT wasn’t just a dip. It was a full-on freefall that left investors scrambling for answers.

If you’ve ever held a biotech stock, you know it’s not for the faint of heart. But Sarepta’s collapse? That’s another level. So, what triggered this crash? Why are analysts bailing? And most importantly — should you stay or run?

That’s exactly what I’ll unpack here. You’re getting the full story from someone who’s been neck-deep in financial analysis and has seen these biotech swings before.

- Why Sarepta’s Elevidys therapy became a double-edged sword

- How FDA warnings shook investor confidence

- The ugly numbers behind Sarepta’s valuation

- What analysts are really saying — not just headlines

- Whether this stock still has a heartbeat

By the end, you’ll walk away with a clear view of Sarepta’s situation and whether this once-promising gene therapy leader still deserves a spot on your watchlist.

What Happened to Sarepta Stock?

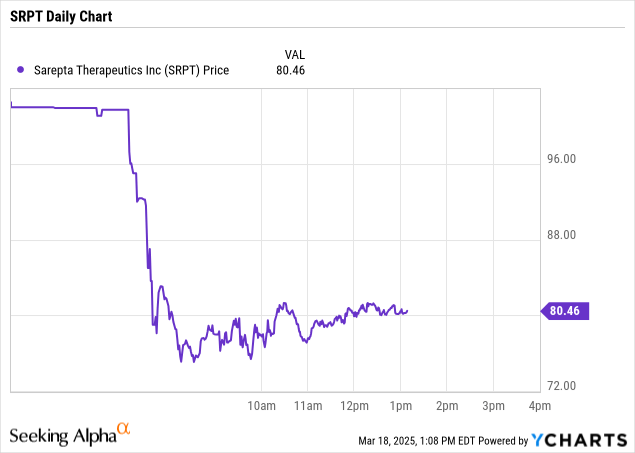

I watched Sarepta (NASDAQ: SRPT) drop 2.17% in a single day. But that was just the tip. In one brutal year, it tanked over 90% from its 52-week high of $150.48 to around $13.32. That’s more than volatility — it’s devastation.

So what caused this? It all started with Sarepta’s lead product: Elevidys, a gene therapy for Duchenne Muscular Dystrophy (DMD). Sounds promising, right? I thought so too — until the FDA hit the brakes.

Elevidys Shipment Halt and FDA Warnings

In July 2025, Sarepta halted shipments of Elevidys. The FDA demanded new safety warnings after patient deaths linked to the therapy, especially in older non-ambulatory patients. That was a big red flag — and Wall Street noticed.

I remember reading the alert and thinking, “this could derail their entire pipeline.” Turns out, I wasn’t wrong. Over half of Sarepta’s projected revenue for 2024 came from Elevidys — a massive $821 million.

Stock Performance Plunge

The chart below speaks for itself. I’ve annotated some of the key inflection points:

Once the news broke, analysts started slashing ratings. Bank of America revised its price target from $20 to just $10 [source]. That’s a signal I take seriously. When big banks jump ship, retail traders need to pay attention.

Key Stats at a Glance

| Metric | Value |

|---|---|

| Current Price | $13.32 |

| Previous Close | $13.62 |

| 52-Week Range | $12.24 – $150.48 |

| Market Cap | $1.31 Billion |

| EPS | -2.64 |

| P/E Ratio | -5.05 |

The Elevidys Fallout

Here’s the harsh truth: when a product that makes up more than 50% of your revenue gets yanked, the rest of the story barely matters. And that’s where Sarepta is stuck.

Elevidys Revenue Dependency

Q2 revenue hit $513 million, and Elevidys was supposed to drive the majority of 2024 income. That’s a risky concentration. I wouldn’t touch a stock that leans this heavily on one unproven therapy without some serious safeguards.

Regulatory Concerns and Market Withdrawal Risk

Here’s what’s worse: if Elevidys is permanently withdrawn, Sarepta’s survival looks grim. FDA label changes now warn about fatal risks. That reduces physician adoption, payer confidence, and basically any shot at recovery.

From my experience covering biotech, once regulators start layering on warnings, it’s a tough hole to climb out of. And that’s exactly where SRPT is stuck.

Analyst Reactions and Ratings

Let’s be clear. Wall Street doesn’t sugarcoat pain. Analysts moved fast. Here’s a snapshot:

- Bank of America: Target cut to $10

- Consensus rating: Mostly “Hold” and “Sell” now

- Few bulls remain — and they’re hanging on hope, not fundamentals

This is why I urge readers to check multiple analyst opinions — not just price targets. Read between the lines. When downgrades outnumber upgrades 4-to-1, that’s a storm warning.

Financial Snapshot

I pulled up Sarepta’s numbers, and I won’t lie — they’re ugly. Negative EPS, negative PE, and zero dividend. This is not a value play, it’s a speculative bet. And right now, the odds aren’t great.

EPS and Valuation Troubles

Earnings per share (EPS) stands at -2.64. That means Sarepta is bleeding money. And with a P/E ratio of -5.05, the market isn’t seeing future profits on the horizon. If you’re holding SRPT hoping for a bounce, you need to be brutally honest with yourself — this isn’t a rebound play right now.

Cash Burn and Potential Restructuring

From what I’ve seen, Sarepta may be forced into cost-cutting. That could mean layoffs or delays in other therapies. When your primary product stalls, it impacts the entire pipeline. I’ve watched companies unravel this way before — it starts with missed earnings, then comes the staff cuts, and eventually dilution.

If they can’t stabilize revenue or secure FDA clearance soon, I wouldn’t be shocked to see a major restructuring announced in their August 6 earnings call.

Sarepta’s Pipeline Beyond Elevidys

So, is Sarepta a one-hit wonder? Not quite. But let me be honest — without Elevidys, the road ahead is steep.

Other Gene Therapies in Development

They do have a pipeline. Sarepta is working on treatments for limb-girdle muscular dystrophies and other RNA-based therapies. These programs show promise, but they’re still early-stage. In my experience, “pipeline potential” means years of waiting, not next-quarter profits.

I’ve seen too many biotechs bet the farm on pipeline assets that never make it past Phase II. Until we get actual trial results or fast-track approvals, it’s all speculation.

Upcoming Regulatory Milestones

According to Sarepta’s latest filings, they’re targeting additional FDA meetings later this year. But again, nothing is guaranteed. The FDA just put them on notice with Elevidys, and that stain could linger.

If you’re still holding SRPT, circle the August 6 earnings date. Any update on regulatory discussions will move the needle — either up or further down.

Overdependence on Elevidys

I can’t stress this enough — Sarepta’s business model relied too heavily on Elevidys. A single therapy driving over half of your revenue is dangerous. I’ve watched similar collapses before, and they almost always follow this pattern of overexposure.

The Role of Ambulatory vs. Non-Ambulatory Patients

This is where things get a little more technical, but I’ll break it down in plain terms.

Safety Outcomes by Patient Segment

Deaths linked to Elevidys happened mostly in non-ambulatory patients — older kids and teens who already had more advanced DMD. In contrast, younger ambulatory patients showed better outcomes and tolerated the therapy better.

So when I dug into the FDA filings, it became clear: the issue isn’t with the therapy itself but who it’s given to. That distinction might help Sarepta secure a limited approval for a smaller patient pool.

Future Access Possibilities

The best-case scenario? The FDA could allow restricted access to ambulatory patients while further safety data is gathered. That could preserve some revenue, but it would be a far cry from Sarepta’s original billion-dollar hopes.

Analyst Forecasts and Stock Outlook

If you’ve made it this far, you probably want to know one thing: is there hope?

Downgraded Price Targets

I won’t sugarcoat it — most major analysts have slashed their targets. Bank of America is calling for $10. That’s below current trading levels, which tells me they don’t expect a rebound soon [source].

Rebound Catalysts?

I always ask this before investing: “What would need to happen for this stock to double?” In Sarepta’s case, a few things:

- Elevidys gets partial reapproval for ambulatory patients

- FDA softens their stance with new safety data

- A pipeline therapy shows breakthrough results

But as of today, none of those are confirmed. So I’m cautious. Real cautious.

Long-Term Viability

I’ve followed Sarepta for years, and I believe they still have scientific credibility. But Wall Street doesn’t pay for credibility — it pays for revenue. Without Elevidys back in the market, they’ll need to raise cash or partner with another biotech just to survive.

FAQs

Why did Sarepta stock drop so much in 2025?

The stock fell over 90% from its high due to FDA warnings about Elevidys, Sarepta’s main gene therapy for DMD. Shipments were halted, and safety concerns emerged after patient deaths, particularly among non-ambulatory patients.

What is Elevidys and why is it important?

Elevidys is a gene therapy targeting Duchenne Muscular Dystrophy. It accounted for more than 50% of Sarepta’s projected revenue. Its success was critical to the company’s future growth and valuation.

Will Sarepta stock recover in 2025?

That depends on FDA actions. If Elevidys is re-approved for ambulatory patients or if Sarepta shows success in other pipeline therapies, a partial recovery is possible. But right now, analysts are mostly bearish.

Is Sarepta a good long-term investment?

It’s a high-risk, high-reward play. Without Elevidys in the market, Sarepta needs another therapy to succeed. If you can tolerate major volatility and want exposure to biotech, it might be worth watching — but don’t expect a quick turnaround.

Final Thoughts

Here’s what I want you to remember:

Sarepta’s collapse was triggered by FDA safety warnings tied to Elevidys. With that therapy sidelined, more than half the company’s revenue is at risk. Analysts are slashing price targets, and the financials paint a bleak picture for the short term.

If you’re holding Sarepta stock, you need to be brutally honest: the road to recovery isn’t guaranteed. This isn’t a typical dip — it’s a full-on disruption of the company’s growth story. Don’t invest on hope. Invest on what’s real.

I’ve seen biotech stories flip before — sometimes for the better, sometimes not. But Sarepta isn’t a storybook stock right now. It’s a case study in overdependence and regulatory risk. Keep it on your radar, but approach with caution. And if you’re waiting for signs of a turnaround, make sure you’re reading the right signals — not just headlines.