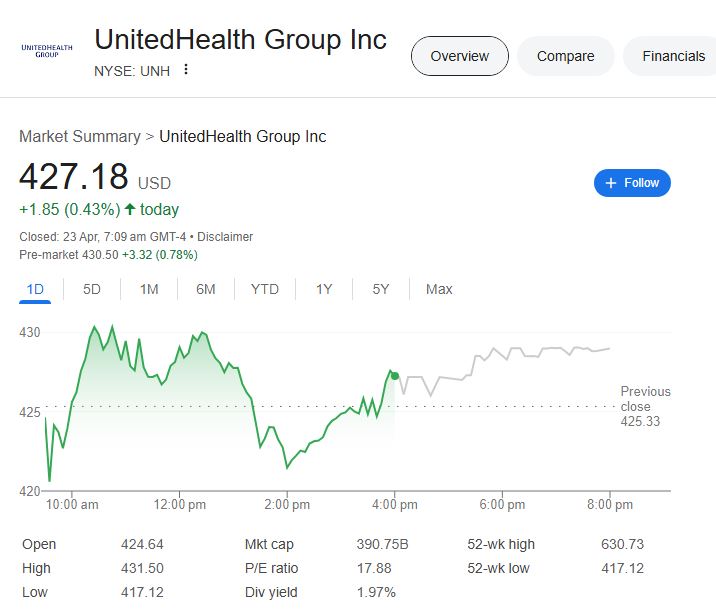

Long praised as a pillar of the American healthcare system, UnitedHealth Group (NYSE: UNH) recently fell to $427.18, barely breaking its 52-week low of $417.12. Although the decline might seem unsettling on paper, the bigger picture is much more complex. UnitedHealth is adjusting altitude rather than crashing, much like a competent pilot easing through a storm.

The stock has experienced modest recoveries in recent days, including a pre-market gain of 0.78%, indicating a cautiously optimistic outlook. When viewed through a long lens, its outlook is remarkably effective, and its fundamentals remain particularly strong despite short-term headwinds that are primarily attributed to Medicare trend pressure.

Company Snapshot – UnitedHealth Stock

| Attribute | Details |

|---|---|

| Ticker | UNH (NYSE) |

| Current Price | $427.18 (as of April 22, 2025) |

| Pre-Market Price | $430.50 |

| 52-Week Range | $417.12 – $630.73 |

| Market Cap | $388.83 Billion |

| EPS (TTM) | $23.88 |

| P/E Ratio (TTM) | 17.88 |

| Dividend Yield | 1.97% (Annual Dividend: $8.40) |

| YTD Change | -15.55% |

| CEO | Andrew Witty (since February 2021) |

| Headquarters | Minnetonka, Minnesota, United States |

| Employees (2024) | 400,000 |

| Official Website | investors.unitedhealthgroup.com |

Financials Show Depth Rather Than Decline

UnitedHealth made $109.57 billion in revenue in the first quarter of 2025, a 9.8% increase from the previous year. Although it barely missed projections, its EPS of $6.85 shows strong operational efficiency, and net income increased by more than 546%. These numbers show that instead of retreating under pressure, the company is recalibrating.

UnitedHealth’s stock has outperformed almost all of its competitors in its category, yielding a 65.96% return over the last five years. This performance demonstrates an incredibly resilient business model powered by data integration, service innovation, and vertical alignment, especially during pandemic-induced disruption and changing regulations.

Optum: The Ecosystem’s Power Source

UnitedHealth has subtly developed a highly adaptable infrastructure that connects pharmacy benefits, telehealth platforms, and claims analytics through its Optum division. Optum has greatly decreased systemic inefficiencies while also enhancing patient outcomes and engagement by utilizing sophisticated data pipelines.

This segment might end up being its most valuable asset in the years to come. From integrated behavioral health to AI-assisted diagnostics, Optum’s innovations in care delivery are not only incredibly successful but also well-positioned to meet the demands of healthcare in the future.

Not a lost opportunity, but a missed quarter

Some analysts downgraded UNH after its recent earnings miss, but others, like Morgan Stanley, revised their targets to $563, pointing to the stock’s undervaluation in relation to its long-term potential. Even though the market’s reaction is reactive, the business’s underlying momentum is unaffected.

UnitedHealth is preparing its services for the future by incorporating value-based care frameworks and predictive modeling. For instance, the business is converting reactive care models into proactive ecosystems by proactively identifying high-risk patients and directing preventive interventions, which is especially advantageous in an aging population landscape.

A Stock That’s Worth Keeping

Few healthcare stocks can match UNH’s level of stability, as evidenced by its forward P/E of 15.54 and beta of just 0.62. It acts as an anchor stock for both conservative and growth-oriented portfolios in light of macroeconomic uncertainty and changing healthcare policy.

The long-term outlook for UnitedHealth may be especially encouraging for investors prepared to withstand temporary volatility. The company is more than just a payer because of its size, diversification, and ongoing innovation; it is a healthtech platform with the architecture to take the lead.

FAQs – UnitedHealth Stock

- Is UnitedHealth stock a buy in 2025?

Yes—especially for investors seeking stability with long-term growth upside. - What is UNH’s dividend yield?

Currently 1.97%, with a consistent annual payout of $8.40 per share. - Why has the stock dropped recently?

Mainly due to Medicare cost trends and a minor earnings miss in Q1. - What’s the long-term performance of UnitedHealth stock?

It has returned 65.96% over the past five years—consistently outperforming peers. - When is the next earnings call?

Expected around July 14, 2025, with analysts watching Optum closely. - What is the updated price target?

Several firms have revised projections upward to $563, suggesting a rebound.