Trading is more than just numbers on a screen. It’s about making decisions under pressure, managing your emotions, and setting goals that truly reflect your capabilities. If you’ve ever struggled with fear or greed in trading, you know how challenging it can be to stay consistent. But, what if I told you the key to trading success isn’t just about technical analysis or market predictions? It’s all about your mindset.

In this article, I’ll share with you the importance of a mindset-centered approach to setting trading goals. We’ll dive into how you can build a disciplined, emotionally intelligent trading strategy that can help you achieve long-term success.

- Why mindset matters in trading goal-setting

- How to use SMART goals for trading success

- Techniques to manage emotions and build discipline

- The role of risk management in goal-setting

- Tracking your progress and adapting your strategy

By the end of this guide, you’ll have actionable insights on setting trading goals that help you stay focused, calm, and more profitable in the long run.

Why Mindset Matters in Setting Trading Goals

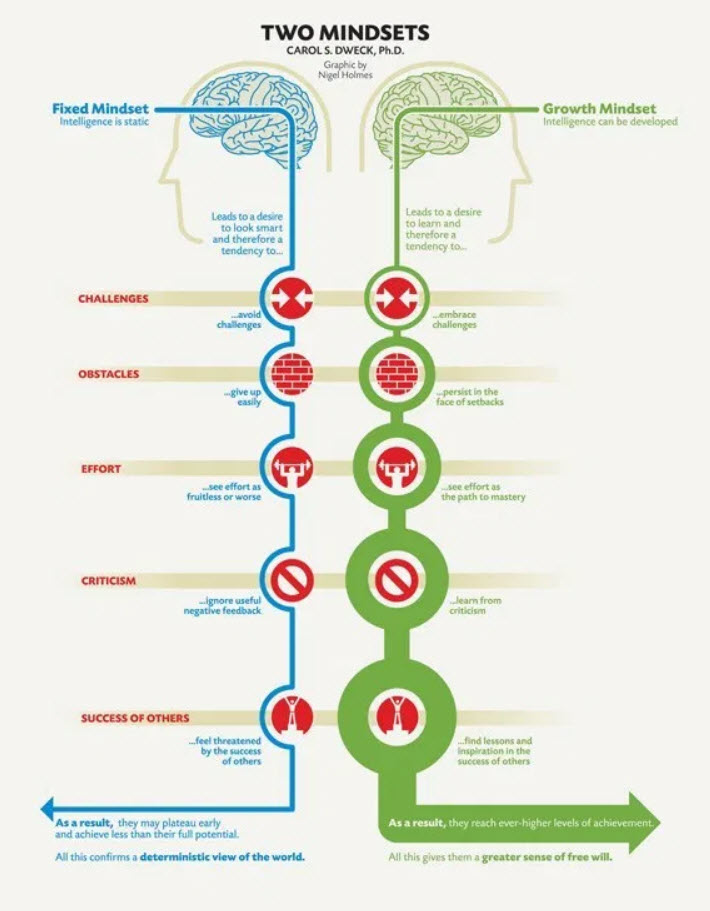

Trading is not for the faint of heart. The emotional rollercoaster, the constant temptation to react impulsively, can easily derail even the most seasoned traders. But, the traders who stick around for the long haul? They understand that success isn’t about avoiding emotions—it’s about managing them.

Let’s face it, we all have biases, and emotions like fear and greed are part of the game. But when you understand how to set goals that align with your emotional triggers, you can make smarter decisions. Emotions don’t rule you—you rule them. That’s where a mindset-centered approach comes in. It’s all about controlling the uncontrollable—your feelings—and using them to fuel your success rather than detract from it.

The Power of SMART Goals in Trading

SMART goals are the gold standard in productivity. But when it comes to trading, they can transform your strategy from wishful thinking into actionable results.

Let me break it down for you:

- Specific: Set clear, unambiguous goals like “I want to earn a 3% monthly return” instead of “I want to be a profitable trader.”

- Measurable: Track your progress by measuring returns, risk levels, and the number of successful trades. This isn’t about hope; it’s about data.

- Achievable: If you’re just starting, expecting a 50% monthly return isn’t realistic. Start small and build your confidence.

- Relevant: Your goals should tie directly into your personal trading strategy, not what other traders are doing.

- Time-bound: Set deadlines—whether it’s weekly, monthly, or quarterly. Without timeframes, goals become a vague wish.

For example, instead of “I want to be successful,” a SMART goal could be: “I will risk no more than 1% of my account balance per trade and aim for a 3% return per month.” This goal is actionable and measurable, which gives you clarity in your trading journey.

Building Emotional Discipline for Trading Success

One of the most powerful aspects of trading is emotional control. I can’t stress this enough: without emotional discipline, you’re bound to make irrational decisions. Ever bought a stock at its peak because you were afraid of missing out? That’s fear talking.

Here’s how I’ve managed my own emotional impulses:

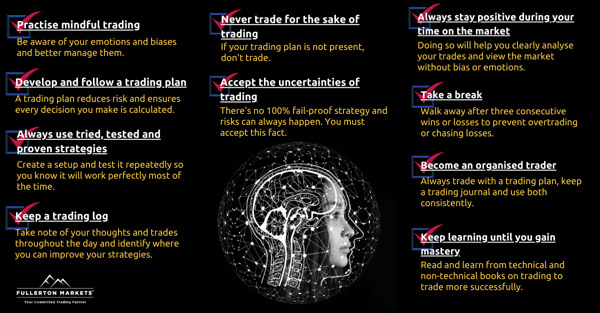

- Mindfulness: Every morning, I take a few minutes to center myself before I start trading. It helps me approach the market with a calm and clear mind.

- Journaling: I track my trades, not just the numbers, but my emotional state during each trade. Over time, I’ve learned how my emotions influence my decisions—and how to prevent them from dictating my moves.

- Post-trade reviews: I review my trades every evening, focusing on what I did right and where I could improve. This helps build a growth mindset, where mistakes are seen as learning opportunities, not failures.

It’s about having the patience to let the market come to you. And when it doesn’t, you need the discipline to sit on your hands. One of the most valuable lessons I’ve learned is this: not every trade is a good trade. Sometimes, doing nothing is the best decision.

The Role of Risk Management in Goal Setting

Even with the best strategy, the market can be unpredictable. That’s why risk management is crucial for trading goals. I’ve always kept one rule close: never risk more than you can afford to lose. This isn’t just about financial loss; it’s about preserving your mental state. If you’re too focused on avoiding losses, you’ll never make consistent gains.

Here are some simple but effective strategies I use:

- Position Sizing: I risk no more than 2% of my trading capital on any single trade. It helps me stay in the game even when I face a string of losses.

- Stop-loss orders: These are non-negotiable for me. I set a predetermined point where I’ll exit a trade if it’s not going my way. It’s about controlling losses, not chasing profits.

- Daily Loss Limits: I set a cap for my daily losses. If I hit that cap, I walk away from the market. This prevents me from making emotional, impulsive decisions out of frustration.

Risk management isn’t just about protecting your money—it’s about protecting your mindset, too. If you know your risk parameters, you’re less likely to panic when the market doesn’t go your way. This helps keep your trading goals on track, no matter the market’s unpredictability.

Tracking and Reviewing Your Progress

Tracking your progress isn’t just about looking at your profits or losses—it’s about understanding your journey. Every trader I know, including myself, has learned that reviewing past trades and performance is crucial for improving future results. Don’t just check your wins—check your losses, too.

I’ve found that using a trading journal has been a game-changer. Here’s why:

- Objective Self-Review: Journals give me a clear record of what I was thinking during each trade. It helps me identify patterns in my emotional reactions and decision-making.

- Setting Milestones: I track both short-term and long-term milestones, such as monthly return rates, risk-to-reward ratios, and improvements in emotional discipline.

- Adaptation: Every week, I assess my journal and see if there are any areas for improvement. If my trades aren’t hitting my goals, I make adjustments. I never stop learning.

After all, growth is about progress, not perfection. And tracking your performance is key to realizing that progress over time.

Patience and Consistency in Trading

When it comes to trading, patience is more than a virtue—it’s a necessity. The market doesn’t move on your schedule, and the more you try to rush things, the more likely you are to make mistakes. I’ve learned this the hard way: chasing the market doesn’t bring success. But sticking to a well-thought-out plan does.

For me, consistency is the key to sustainable trading. Here’s how I’ve built it into my daily routine:

- Stick to the plan: I never make a trade unless it fits my strategy. No matter how tempting it might be to jump on a “hot tip,” I stay disciplined.

- Follow the strategy: Every day, I remind myself of my long-term goals and strategy. I don’t let short-term market moves sway me.

- Celebrate small wins: I don’t just focus on big profits. I celebrate consistency, the little wins, and staying disciplined. It keeps me motivated and on track.

Remember, trading isn’t about making big profits in a short period. It’s about consistently making smart decisions and being patient. The patience to wait for the right setup and the consistency to stick with your plan—this is what separates successful traders from the rest.

Tracking and Adapting Your Goals

We all know that life doesn’t always go as planned, and trading is no different. That’s why adapting your goals as you progress is crucial. When I first started trading, I set ambitious goals—perhaps too ambitious. Over time, I realized the importance of adjusting my expectations based on my experiences and progress.

Here’s what I’ve learned:

- Review and reassess: Every few months, I review my trading goals and progress. If something isn’t working, I don’t hesitate to change my approach.

- Adjust goals as needed: For example, if I’ve been hitting my return goals, I might raise my target. If I’m struggling with consistency, I might lower the bar and focus more on discipline than returns.

- Continuous learning: The market evolves, and so should you. I make it a point to continue learning from my trades and the market itself, adapting accordingly.

Adapting your goals doesn’t mean abandoning them—it’s about ensuring they stay relevant and achievable. Flexibility is key to long-term success.

Achieving Long-Term Success with the Right Mindset

By now, it should be clear: achieving success in trading isn’t about blindly following tips or hoping for the best. It’s about building a mindset that supports your trading goals. The right mindset helps you set realistic goals, stick to them, and adjust when necessary, all while managing your emotions and mitigating risks.

My key takeaways are simple:

- Set clear, realistic goals: Make them specific, measurable, and time-bound. This gives you a roadmap for success.

- Stay emotionally disciplined: Control your emotions and avoid impulsive decisions. Stay calm, focused, and patient.

- Incorporate risk management: Protect your capital. Use stop-loss orders and position sizing to minimize risk.

- Review and adapt: Be flexible with your goals. If something’s not working, adjust. Don’t be afraid to change your strategy to improve results.

The road to becoming a successful trader isn’t easy, but with the right mindset and goals in place, it’s much more achievable. Stay disciplined, stick to your plan, and always strive for improvement. That’s how you’ll achieve long-term success in trading.

FAQs

What is the best way to set realistic trading goals?

The best way to set realistic trading goals is to use the SMART framework. Make sure your goals are specific, measurable, achievable, relevant, and time-bound. Focus on small, consistent improvements rather than aiming for unrealistic returns right away.

How can I overcome emotional challenges like fear and greed in trading?

Overcoming fear and greed requires emotional discipline. Use techniques like mindfulness, journaling, and post-trade reviews to manage your emotions. Recognize when these emotions influence your decisions, and take a step back before making a trade.

Why is risk management crucial for trading success?

Risk management is crucial because it protects your capital and prevents significant losses. Using strategies like stop-loss orders and position sizing helps you control your exposure to market volatility and ensures that one bad trade doesn’t derail your entire account.

How can I track my progress toward achieving my trading goals?

Tracking progress involves recording each trade, reviewing your performance regularly, and adjusting your strategies based on the results. Keep a trading journal to note the emotional factors influencing your decisions and assess your risk-to-reward ratios to make data-driven improvements.

By following these steps and staying consistent with your approach, you can achieve greater success in your trading journey. Always remember: the market will test you, but with the right mindset, you’ll be ready to pass every challenge it throws your way.

Learn more about trading psychology.