Overtrading is a silent killer for many traders, especially in the fast-paced world of Forex. We’ve all been there—feeling the rush of success after a winning trade, only to let our guard down and make impulsive decisions that cost us more than we bargained for.

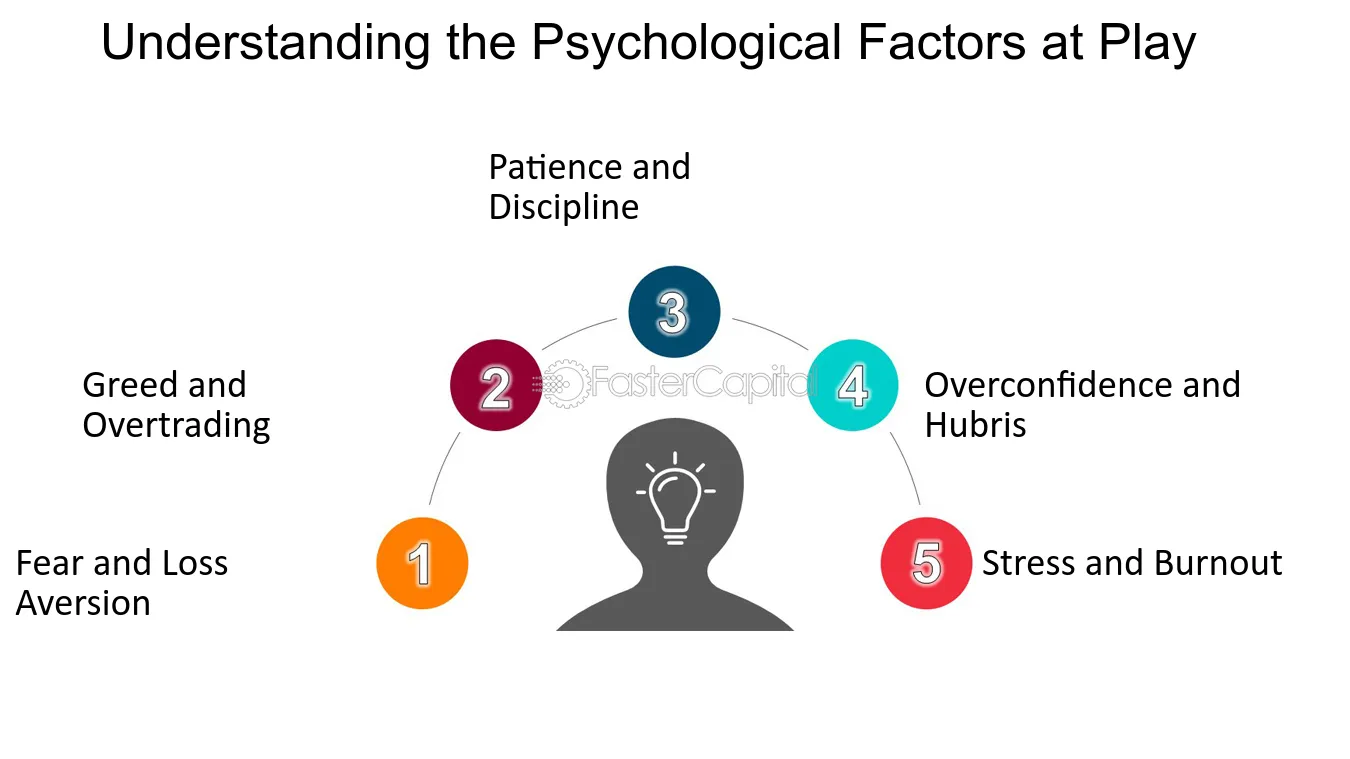

But here’s the truth: Overtrading is often driven by psychological triggers—emotions like greed, fear, and excitement that push us to act without thinking. And that’s where the real danger lies. The more you understand the emotional aspects of your trading behavior, the more control you can take back.

The Solution? By identifying the psychological triggers behind overtrading, you can break free from the cycle and start trading with a clear mind. In this article, we’ll explore the key psychological factors that lead to overtrading and provide strategies to help you regain control of your trades.

- The Dopamine Loop: Understanding the Rewards of Trading

- Emotional Triggers: Greed, FOMO, and Anxiety in Trading

- Compulsive Behavior and How to Break the Cycle

- Effective Strategies to Stop Overtrading

What makes this article different? This isn’t just a generic guide. It’s about understanding your unique triggers and providing tailored advice on how to take charge of your emotions. So, if you’re ready to start trading smarter (not harder), read on!

Understanding the Psychological Triggers of Overtrading

The Dopamine Loop: How Winning Trades Trigger Overtrading

Overtrading often starts with dopamine—the brain’s reward neurotransmitter. Each time you make a profitable trade, your brain gets a hit of dopamine. It feels good, right? Well, this surge encourages you to seek that same “high” again and again. The problem is, this can lead to compulsive behavior, where you chase wins without proper strategy or discipline. Before you know it, you’re placing trades purely for that rush, not because it’s the right decision.

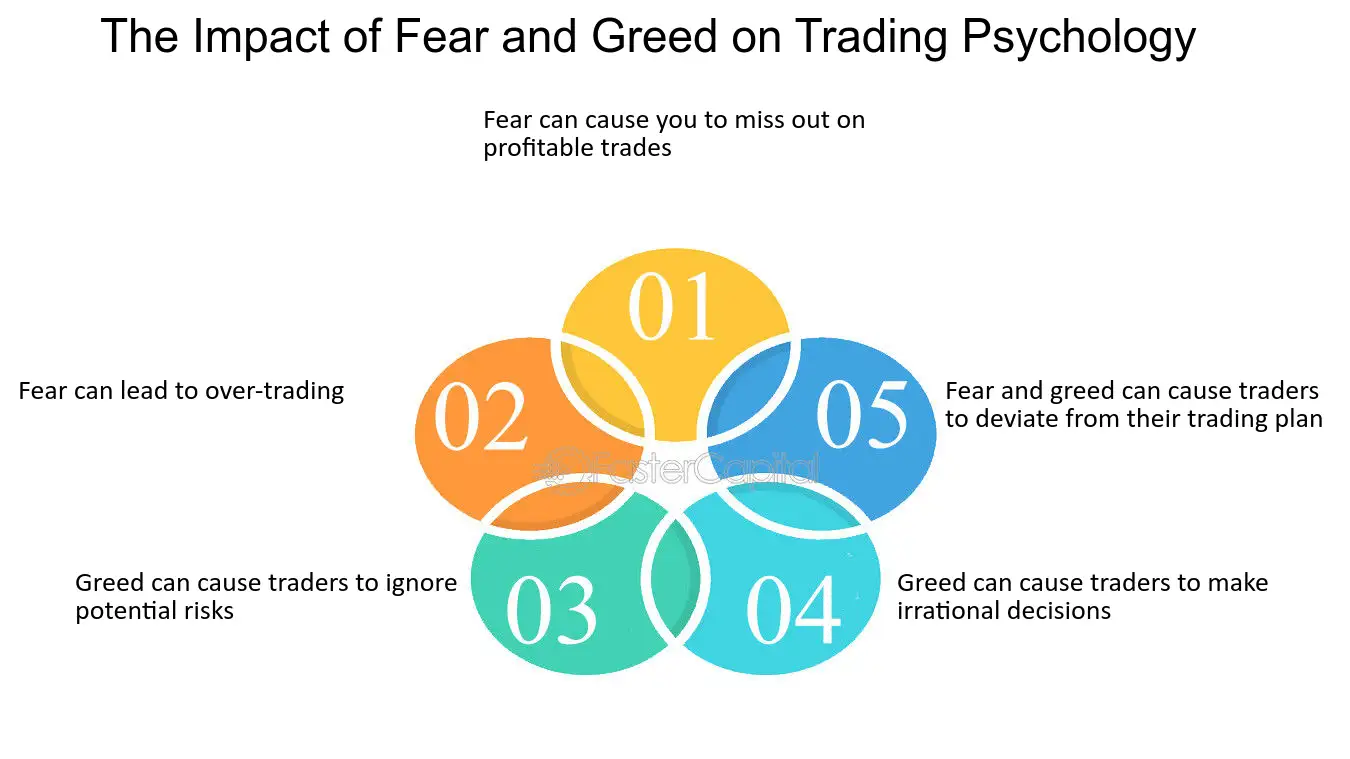

Emotional Triggers: Greed, FOMO, and Anxiety

When you’re constantly bombarded with images of other traders making massive gains, it’s easy to fall into the trap of FOMO (Fear of Missing Out). This fear of missing out on the next big win can push you to act impulsively—placing trades without fully understanding the risks involved.

Then there’s greed. We’ve all seen those charts with sky-high returns, and we think, “I want that too!” But greed often clouds our judgment, making us take risks we otherwise wouldn’t. Trading with the hope of becoming a millionaire overnight rarely leads to success—it often leads to losses.

Compulsive Behavior and Ego Preservation

Psychoanalytic theories suggest that some traders may experience what’s called repetition compulsion, where they subconsciously repeat the same behaviors, even when those behaviors are risky. This is often driven by the ego’s desire to “correct” past mistakes. If you’ve ever tried to make up for a loss by taking even bigger risks, you’ve probably fallen into this trap.

Another aspect is ego preservation. Sometimes traders place trades to protect their self-esteem. If they’ve had a bad run of trades, they might overcompensate with risky moves just to “prove” to themselves they’re not a failure. However, this only exacerbates the problem.

The Warning Signs of Overtrading

How to Recognize Emotion-Based Decision-Making

If you’re making decisions based on feelings of fear, excitement, or anxiety rather than following a clear plan, that’s a red flag. Emotional trading often leads to unpredictable outcomes. If you find yourself justifying trades that feel “right” but don’t have a logical basis, then it’s time to take a step back.

Persistent Anxiety and Stress

Overtrading doesn’t always look like a series of bad trades. Sometimes, it manifests as persistent anxiety. If you’re feeling antsy or jittery when you’re not trading, or if you feel compelled to check the market constantly, it might indicate that you’re in an unhealthy cycle of overtrading. This anxiety can make it difficult to think clearly and rationally about your trades.

Revenge Trading: Responding to Losses with More Trades

Have you ever experienced a loss and immediately placed another trade in an attempt to “get back” what you lost? This is known as revenge trading. It’s emotional, and it’s dangerous. Often, revenge trading leads to even larger losses, and it can spiral out of control.

Practical Strategies to Stop Overtrading

Establishing a Clear Trading Plan

The best way to stop overtrading is by having a well-defined trading plan. You need to set clear entry and exit points for each trade. Before you place a trade, ask yourself: “Does this align with my strategy?” If you can’t confidently answer yes, then don’t trade. The more structured your plan, the easier it is to stick to it and avoid impulsive decisions.

Limiting the Number of Trades per Day

Set a rule for yourself: limit the number of trades you make each day. Whether it’s 3, 5, or 10, sticking to a fixed number helps you avoid the temptation to trade just for the sake of it. I’ve found that sticking to this rule forces me to be more selective with my trades, leading to better decision-making.

Using the “5-Second Rule”

One trick that I personally use is the “5-second rule.” This is simple: before placing any trade, take a deep breath and count to five. This brief pause allows your emotional impulses to settle and gives your rational mind time to catch up. If you still feel the urge to trade after that brief pause, then proceed—but often, the pause helps me realize that I don’t actually need to make the trade.

Recognizing and Interrupting Emotional Patterns

The first step to managing overtrading is recognizing when emotions like excitement, fear, or frustration are influencing your decisions. Once you’ve identified the triggers, you can take proactive steps to interrupt these emotional patterns. For example, if you notice yourself feeling overly confident after a win, it’s important to pause and ask yourself whether your next trade is truly based on logic or driven by emotion.

Building Non-Trading Habits to Reset Your Mind

Traders often get stuck in a mental loop, constantly thinking about the next trade, even when they’re away from the market. One of the best ways to break this cycle is to establish non-trading habits that help reset your mind. Activities like exercising, reading, or engaging in hobbies outside of trading can help take your mind off the screen and provide the mental reset needed to approach your next trade with a clear head.

The Importance of Accountability and Coaching

If you struggle with overtrading, having someone to hold you accountable can be a game-changer. I’ve personally found that working with a mentor or coach helps me stay grounded and stick to my strategy. Regular check-ins with a coach or trading buddy can help you maintain objectivity, making it easier to break free from emotional impulses that lead to overtrading.

Focus on Process, Not PnL

One of the most powerful shifts in mindset is focusing on the process of trading, rather than obsessing over profits or losses. It’s tempting to measure success solely by the numbers on your screen, but this can lead to emotional decision-making. Instead, focus on executing your strategy as planned. If you can consistently follow your strategy and manage your emotions, the profits will naturally follow.

Building a Balanced Trading Mindset

Emphasizing mental health is crucial to becoming a successful trader. Overtrading often stems from an unbalanced mindset, where the desire for profits outweighs the need for discipline. In my experience, taking care of your mental health—whether through mindfulness practices, regular breaks, or therapy—can make a significant difference in the long-term success of your trading journey.

Final Takeaway

Overtrading is not just about placing too many trades; it’s about trading without control, driven by emotions that undermine your strategy. By understanding the psychology behind overtrading, recognizing emotional triggers, and implementing practical strategies, you can take control of your trading behavior. Start by setting a clear trading plan, limiting the number of trades you make each day, and building habits that reset your mind.

Closing Thought

Remember, trading isn’t a race—it’s a marathon. Stay disciplined, manage your emotions, and stick to your plan. Over time, you’ll not only stop overtrading, but you’ll also become a more confident and successful trader.

FAQ

What are the common emotional triggers that cause overtrading?

The most common emotional triggers are greed, fear of missing out (FOMO), and frustration from losses. These emotions can push traders to act impulsively, ignoring their trading plan. For example, a trader who is frustrated after a loss may attempt to recover quickly by placing a high-risk trade, often leading to further losses.

How can I recognize when I’m overtrading?

Overtrading often occurs when you feel anxious or excited about missing a trade opportunity. If you find yourself trading without clear reasoning or constantly checking the market, these could be signs of overtrading. Additionally, if you’re placing trades impulsively to “make up” for losses, that’s a major red flag.

What steps can I take to stop overtrading and improve my trading discipline?

The first step is to set a clear trading plan and stick to it. Limit the number of trades you make each day, and pause before placing a trade to evaluate your emotional state. Incorporating activities outside of trading—like exercise or hobbies—can also help reset your mindset and prevent compulsive trading.

External Links

For further reading on the psychology of trading and managing emotions, check out these resources:

Media Ideas

To enhance the article, you could include:

- Charts that show how emotional triggers correlate with increased trading activity.

- Videos explaining the “5-second rule” in trading to give readers a practical tool for managing emotional impulses.

- Infographics illustrating key steps to take when feeling the urge to overtrade, including examples from successful traders who overcame overtrading.