Confidence in trading is essential, but it’s all too easy to tip the scale into overconfidence.

As a trader, you probably know that confidence can make or break your success. You need a solid belief in your strategies, decision-making, and ability to handle the market’s twists and turns. However, there’s a fine line between having confidence and letting your ego take control. Overconfidence can lead to reckless decisions, larger-than-life risks, and ultimately, major losses. So, how do you build lasting confidence while avoiding the traps that come with overconfidence?

It’s not just about accumulating wins or riding high on a streak. True confidence comes from mastering your emotions, understanding your strategy, and continuously improving as a trader. In this article, we’ll explore how to develop confidence that serves you well, without letting it spiral into overconfidence.

Key Topics We’ll Cover:

- The dangers of overconfidence in trading

- Building real confidence through discipline and planning

- Managing psychological triggers that can lead to overconfidence

- The importance of realistic goals and tracking your progress

- How risk management keeps your confidence grounded

At ChronosTrading, we value transparency and integrity in trading. Our goal is to empower you with the tools to build genuine confidence, all while managing the risks inherent in Forex and CFD markets.

What is Trading Confidence?

When you think of confidence in trading, what comes to mind? For most of us, it’s the feeling of assurance in our decisions and actions. But true trading confidence isn’t about thinking you can predict the market’s every move. It’s about trusting in your approach and sticking to your plan, even when the market is unpredictable. Confidence comes from having a clear strategy, adhering to your trading plan, and managing risk effectively. It’s about knowing that no matter what happens, you’ve done your due diligence and made informed decisions.

The Difference Between Confidence and Overconfidence

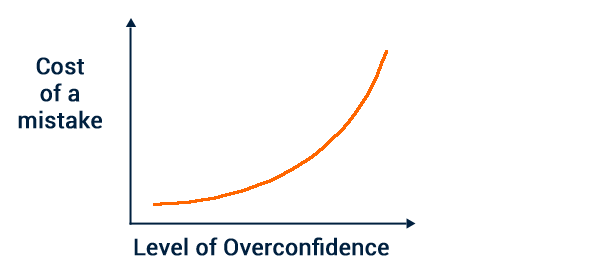

While confidence is grounded in reality and preparation, overconfidence is often the result of past success or excitement from a hot streak. It can cloud judgment and lead to impulsive decisions. Overconfident traders may ignore risk management or increase position sizes beyond their comfort zone, thinking they’re invincible. Unfortunately, this can quickly turn into catastrophic losses.

The Dangers of Overconfidence in Trading

Overconfidence often sneaks in after a winning streak. You think you’ve cracked the code, and that can lead to risky behavior. But what happens when the market turns? Overconfident traders may disregard key rules like maintaining appropriate position sizes, using stop-loss orders, or managing risk per trade.

Overestimating Your Abilities

Think back to your most recent trading success. Did it feel like you could do no wrong? Maybe you even started making bigger trades or took on higher risks, all in the name of “confidence.” The problem is, the market doesn’t always play by your rules, and those higher stakes can quickly lead to bigger losses. Overconfidence blinds you to the risk, and that’s when the markets can humble even the most seasoned traders.

Psychological Pitfalls of Overconfidence

The human mind is tricky. When we feel overconfident, we’re more likely to ignore cognitive biases such as confirmation bias. We seek out information that aligns with what we already believe, rather than critically analyzing all available data. This can lead to poor trading decisions that are not based on a well-rounded assessment of the market.

How to Build Sustainable Confidence in Trading

Building confidence that lasts takes time. It’s not about getting lucky in one trade—it’s about cultivating disciplined habits and staying focused on the long-term. Let’s dive into some key practices that can help you build lasting confidence.

Develop a Solid Trading Plan

One of the first steps to building confidence is having a clear and actionable plan. This plan should outline your entry and exit strategies, risk management protocols, and your financial goals. Knowing exactly what your strategy is will help you stick to your rules, even when the market gets volatile.

Keep Emotions in Check

One of the hardest parts of trading is managing your emotions. Fear, greed, and overconfidence can all cloud judgment. One of the best ways to maintain a clear mind is by sticking to your trading plan and avoiding the temptation to deviate from it when things get tough. Regularly reviewing your trades and understanding where your emotions played a role can help you learn from each experience and improve over time.

Risk Management: The Foundation of Real Confidence

True confidence is built on a foundation of solid risk management. If you don’t manage your risk, your confidence will be short-lived. This includes understanding how much of your account you’re willing to risk on each trade and ensuring you’re not overexposing yourself in any one position. Use stop-loss orders and diversify your trades to limit the potential for massive losses.

Setting Realistic Goals for Confidence Building

Confidence doesn’t happen overnight. It’s a gradual process of improving your skills, refining your strategies, and continuously evaluating your performance. Setting realistic, incremental goals can help you stay focused on progress, not perfection. Whether it’s improving your win rate, increasing your risk-to-reward ratio, or simply sticking to your trading plan, these small wins add up over time and help reinforce your confidence in your trading abilities.

Tracking Your Progress

As with any skill, trading requires consistent practice and feedback. Keep a trading journal where you document your strategies, emotions, and outcomes. This can be a powerful tool for growth, as it allows you to see patterns in your behavior and helps you adjust when needed. Celebrating small victories—like sticking to your plan through a tough trade—can help reinforce positive habits and improve your confidence level.

The Role of Risk Management in Maintaining Confidence

When it comes to building lasting confidence, risk management is non-negotiable. The truth is, even the most experienced traders experience losses. What differentiates successful traders from the rest is their ability to manage risk and bounce back after setbacks. If you fail to incorporate solid risk management techniques, any confidence you’ve built can quickly dissipate after just one or two bad trades.

Stick to Your Limits

One of the most important aspects of risk management is defining your limits. This means setting your stop-loss levels before entering a trade and ensuring that the potential loss on any given trade won’t jeopardize your entire trading account. A sound trading plan takes into account how much of your total account balance you’re willing to risk per trade (usually around 1-2%). This discipline will allow you to keep a level head and protect your capital in the long run.

Leverage: Use It Wisely

Leverage is a powerful tool, but it can be a double-edged sword. It’s easy to fall into the trap of overleveraging when things are going well. But remember, overleveraging can lead to significant losses if the market moves against you. Use leverage cautiously, and make sure to adjust your position sizes based on your confidence level and risk tolerance.

Common Mistakes That Lead to Overconfidence

While confidence is important, overconfidence can quickly ruin your trading career. Let’s take a look at some common mistakes traders make when they become overconfident and how you can avoid them.

Ignoring Stop-Loss Orders

After a few wins, you might feel like you’ve mastered the market. This is when many traders begin to think they don’t need to use stop-loss orders anymore. Overconfidence can lead to abandoning these essential risk management tools. Stop-losses are there to protect you from unexpected market movements. Ignoring them is a recipe for disaster.

Increasing Position Sizes Too Quickly

Overconfident traders often feel invincible after a winning streak. They may increase their position sizes to capitalize on their success, which can quickly spiral out of control if the market turns. It’s essential to stay grounded and increase position sizes gradually while keeping risk in check. Remember, it’s better to make consistent small profits than risk it all on one big trade.

Overtrading and Taking Excessive Risks

After a series of successful trades, you might feel the urge to trade more frequently. Overtrading is a direct result of overconfidence and often leads to excessive risks. Successful traders know that sometimes, the best trade is no trade at all. Stay patient, stick to your strategy, and wait for the right opportunities to enter the market.

How to Avoid Emotional Trading

As a trader, your emotions can be both your greatest strength and your biggest enemy. Fear, greed, and overconfidence are powerful psychological triggers that can influence your decision-making and lead to emotional trading. To build sustainable confidence, it’s crucial to manage your emotions effectively.

Stay Objective, Not Subjective

One of the biggest mistakes traders make is allowing emotions to dictate their decisions. Whether it’s fear of missing out on a trade or the exhilaration of winning big, emotional decisions can cloud your judgment. A good rule of thumb is to make trading decisions based on facts, data, and your trading plan—never emotions. Stick to your strategy and avoid making impulsive decisions that are based on how you feel in the moment.

Take Breaks

If you’ve had a series of emotional trades, step back. Taking regular breaks from trading can help you regain your mental clarity and prevent emotional burnout. The markets will always be there, but your mental health and trading discipline are the keys to long-term success.

Tracking Your Progress and Celebrating Small Wins

Building confidence as a trader isn’t just about avoiding mistakes—it’s also about recognizing and celebrating your improvements along the way. Tracking your progress helps you stay focused and allows you to identify areas for further development.

Use a Trading Journal

One of the most effective ways to track your progress is by keeping a detailed trading journal. In your journal, note down the trades you made, the reasoning behind them, the emotions you felt, and the outcome. This exercise allows you to reflect on what’s working and what’s not, which helps you continuously improve and stay confident in your decision-making.

Celebrate the Small Wins

Confidence is often built on small successes, not giant leaps. Every time you stick to your trading plan or make a successful trade, give yourself credit. These small wins accumulate and gradually build your confidence. It’s essential to acknowledge your improvements, even when they seem minor, because over time, they lead to significant progress.

FAQ

How do I avoid becoming overconfident in trading?

To avoid overconfidence, it’s crucial to maintain a disciplined approach. Stick to your trading plan, use proper risk management strategies, and don’t let short-term successes cloud your judgment. Regularly review your trades, and always be aware of the psychological triggers that might lead to overconfidence, such as past wins or market excitement.

What are the best ways to build trading confidence without risking too much?

The key is consistent, realistic goal setting and focusing on steady progress. Start with smaller position sizes, manage your risk effectively, and track your performance. The more disciplined and objective you are, the more your confidence will grow. Over time, you’ll develop a deeper understanding of the market, which will help reinforce your confidence without the need for reckless risk-taking.

How can psychological triggers impact my trading decisions?

Psychological triggers like fear, greed, and overconfidence can cause you to make emotional decisions. For example, fear of missing out (FOMO) can lead you to jump into trades impulsively, while greed can cause you to increase position sizes unnecessarily. These emotional decisions often result in poor trading outcomes. To avoid this, practice mindfulness, stick to your plan, and take breaks when you feel emotionally overwhelmed.

Final Takeaway: Building true confidence as a trader isn’t about quick wins or lucky streaks. It’s about developing a disciplined, patient approach to the markets, avoiding emotional trading, and making decisions based on solid strategies rather than fleeting emotions.

Closing Thought: Confidence in trading comes with time, experience, and learning from both your successes and failures. Stay grounded, stick to your plan, and keep working on your skills—you’ve got this!